Calculate hourly rate for semi monthly payroll

Also check out some of our similar calculators like the Hourly. Federal income tax rates range from 10 up to a.

What Is A Pay Period How Are Pay Periods Determined Ontheclock

Ad Compare This Years Top 5 Free Payroll Software.

. Content updated daily for semi monthly payroll calculator. Federal Paycheck Quick Facts. Total the Hours Worked for the Week 3.

Divide the actual numbers of hours worked by number of available hours in the pay cycle. Connect Xero to Your Bank for Automatic Bank Feeds. As can be seen the hourly rate is multiplied by the number of working days a year unadjusted and subsequently multiplied by the number of hours in a working day.

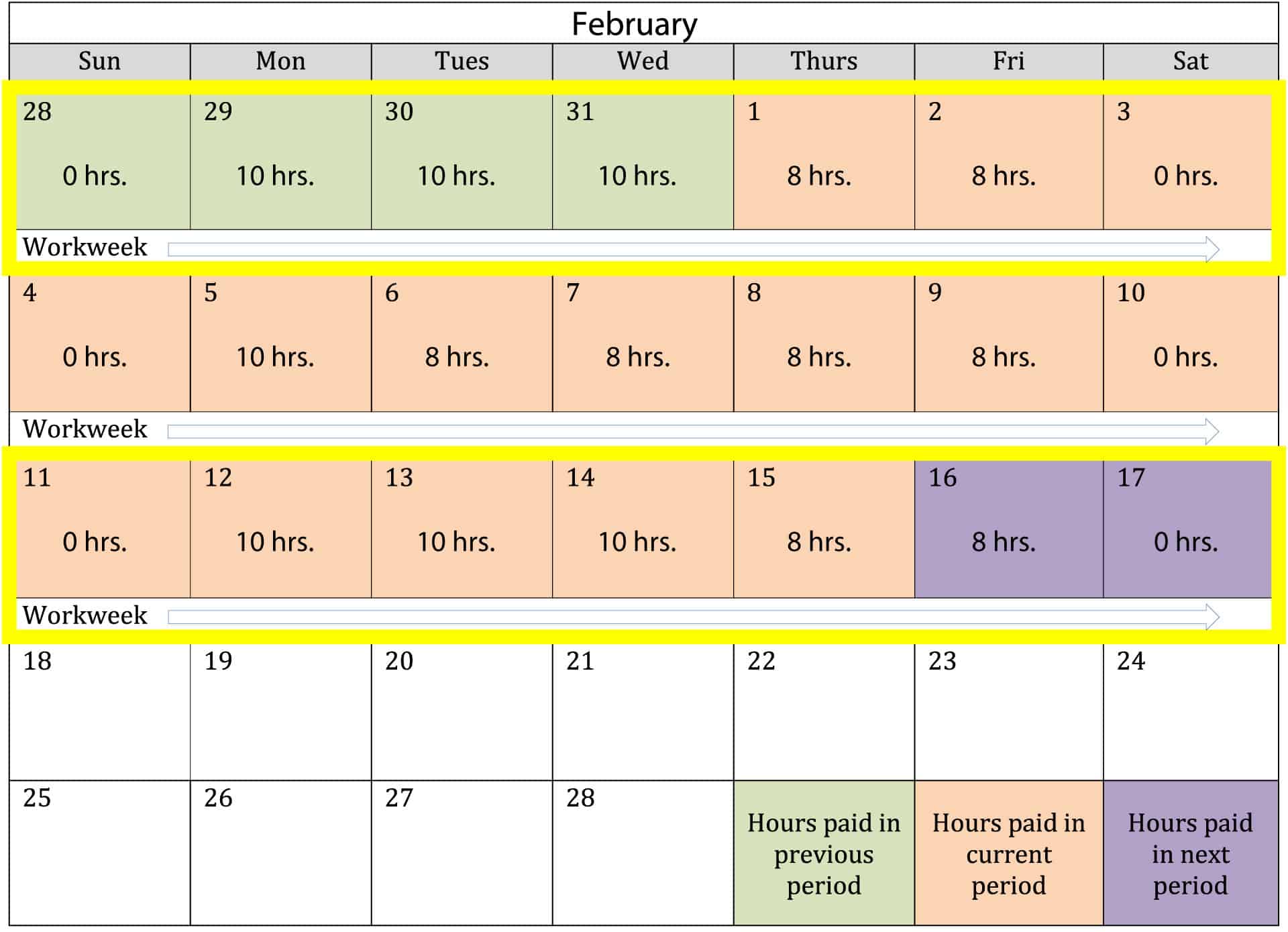

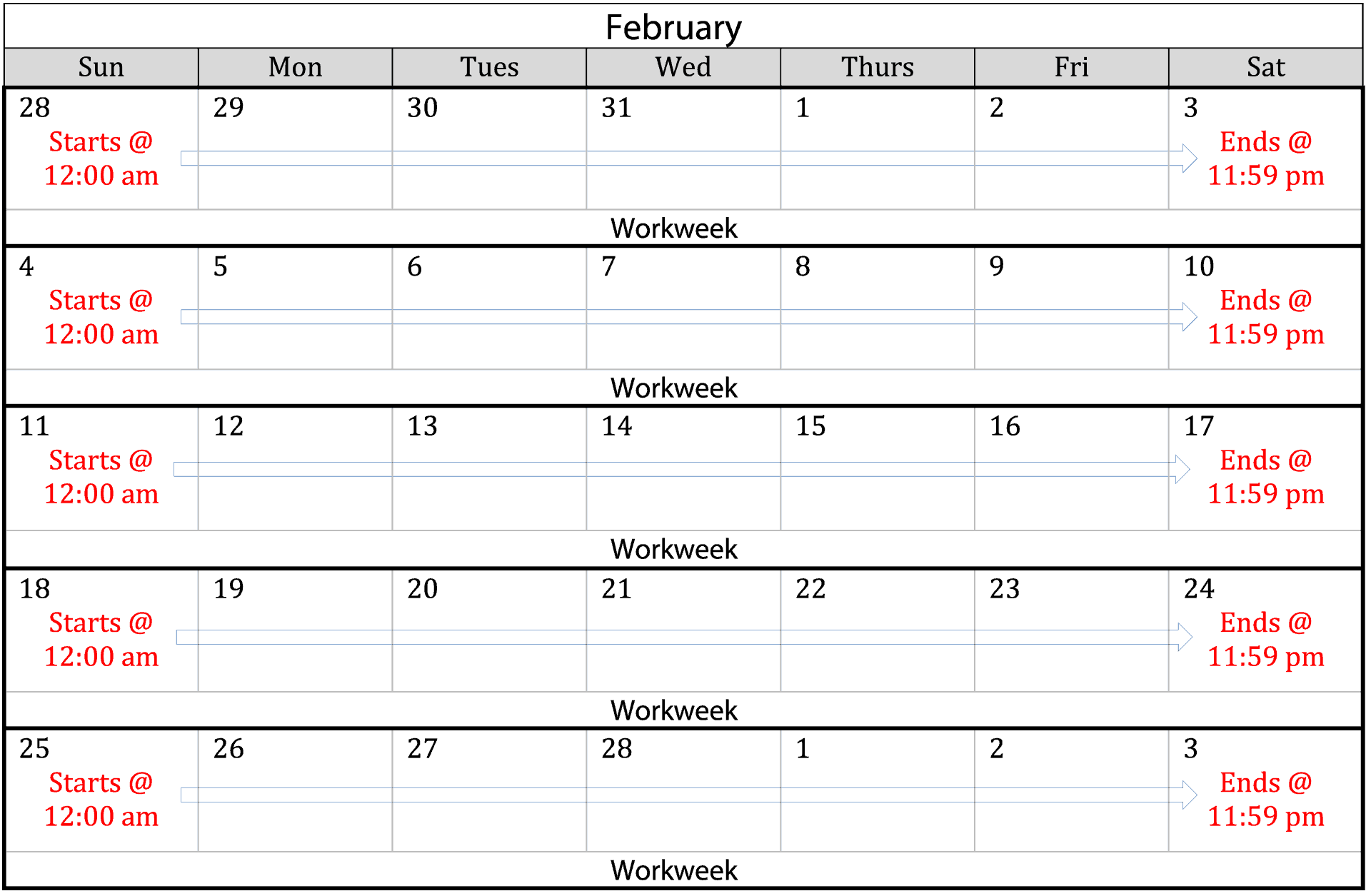

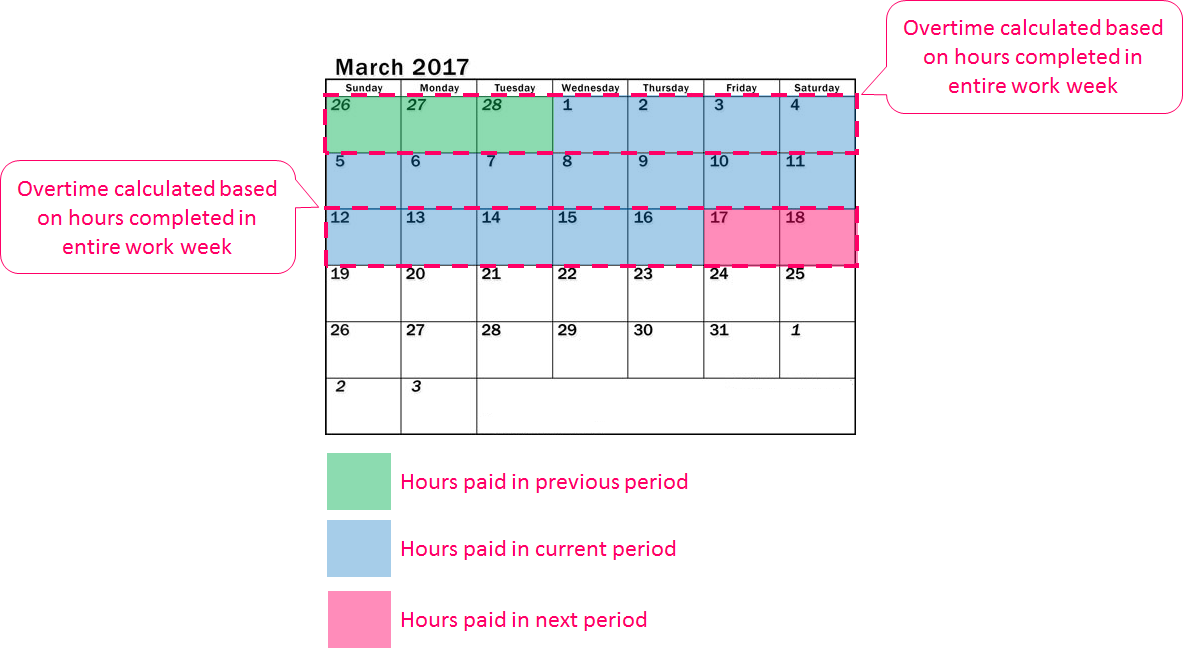

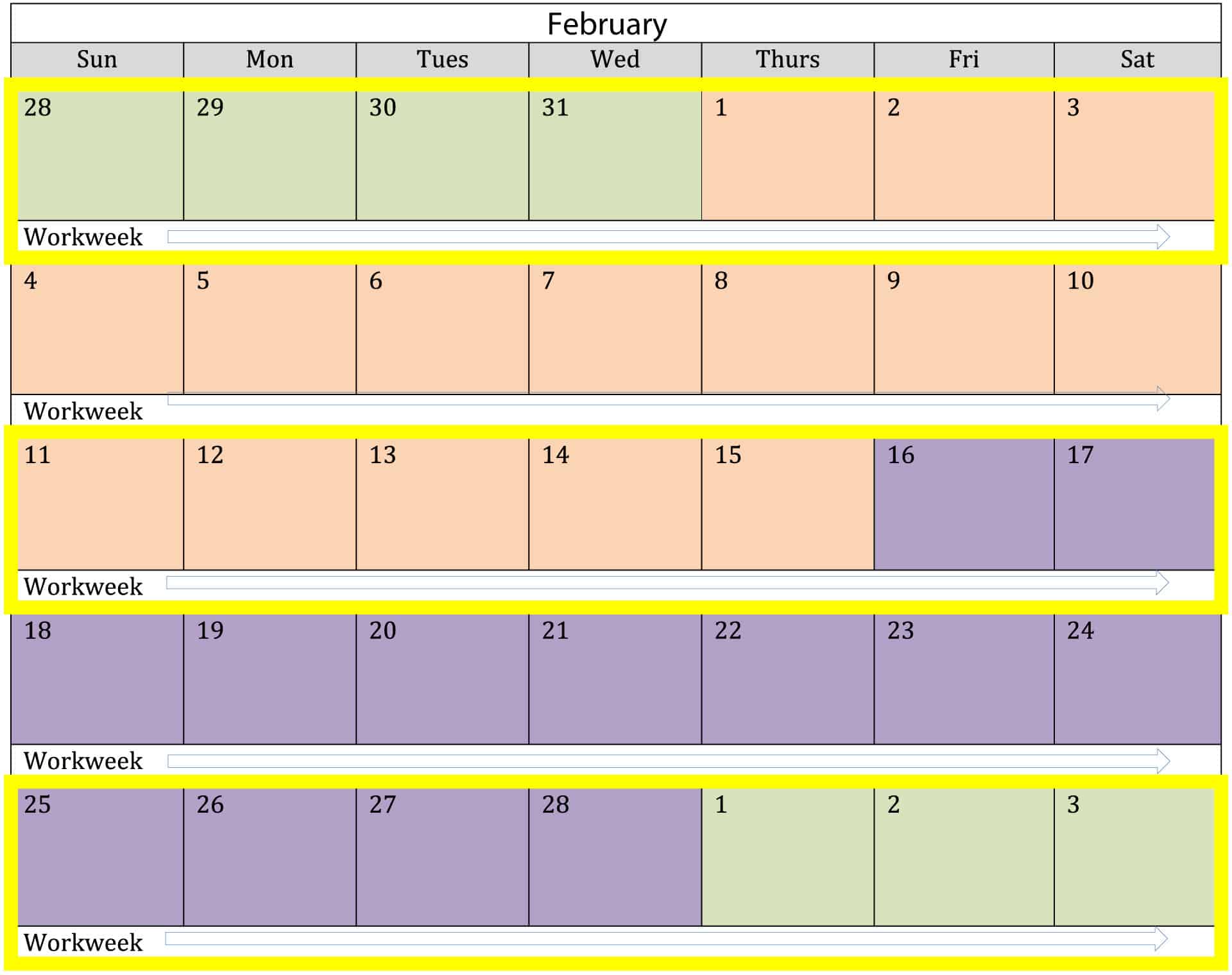

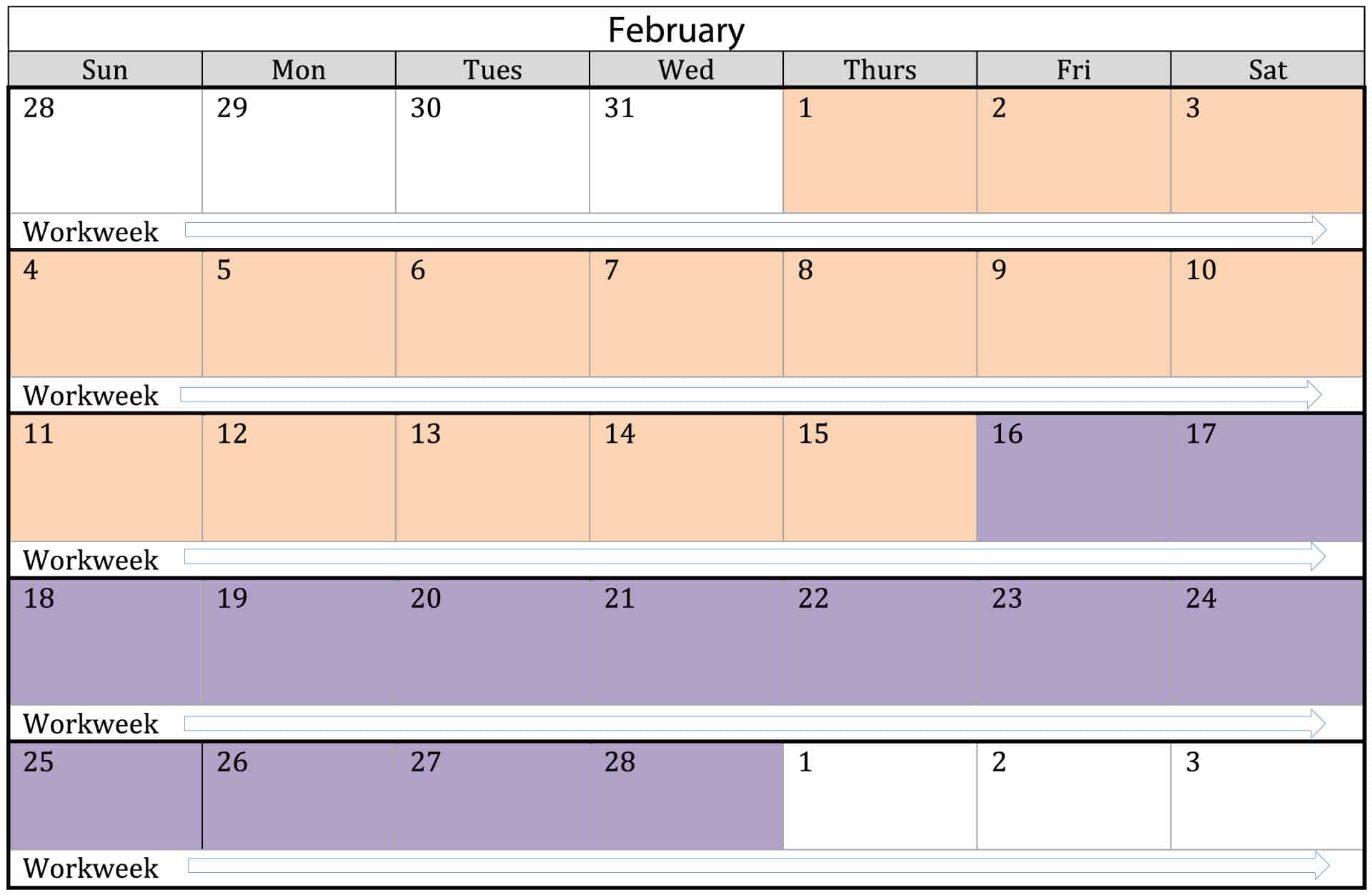

Separate into Workweeks 2. For instance if you worked 70 regular hours during the semi-monthly pay period and earned 10 per hour you. To calculate the number of overtime hours worked add the number of hours worked in.

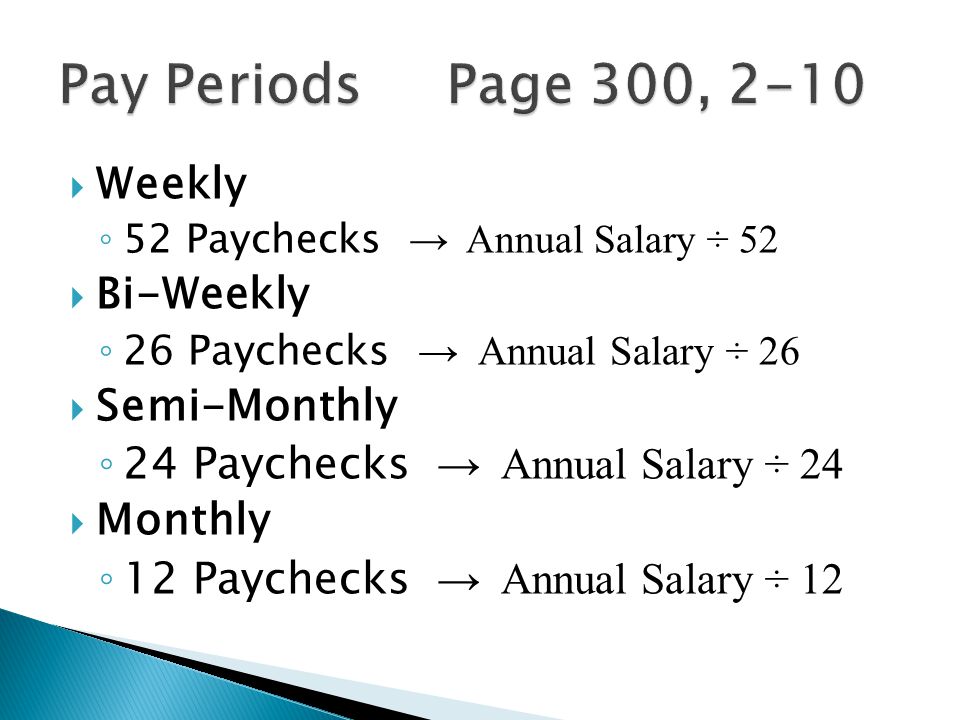

How to calculate annual income. 1500 per hour x 40 600 x 52 31200 a year. You can calculate this by dividing the 2080workdayss by the 24 semi-monthly payrolls.

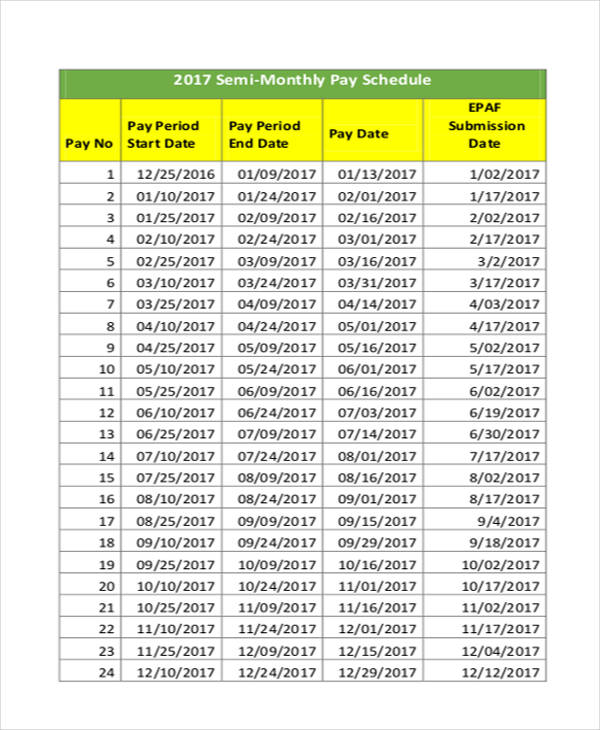

A semi-monthly payroll occurs twice each month and 24 times each year. Pay Calculations To Determine Semi-Monthly Gross Pay. Multiply 188 by a stated wage of 20 and you get 3760.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Subtract the number of calendar days in the pay period from the total gross semi-monthly. If your monthly pay is flat based on an annual salary then you would simply divide the salary by 12 to come up with.

If all you have is the annual gross salary paid semi-monthly divide this value by 2080 the average number of work hours in any calendar year. If you or your employee made. So if you want to calculate a semi-monthly daily rate divide your employees annual salary by 260.

Multiply the result in Step 1. For both of these reasons you should be aware of your employees daily rate. Payroll Seamlessly Integrates With QuickBooks Online.

Multiply an employees semi-monthly salary by two to find the. As a result of this salaried employees are paid for 8667 hours each semi-monthly pay period. Ad Accounting Software With Everything You Need To Run Your Business Beautifully.

Calculate and Divide Multiply hours worked by your hourly rate. Below is an example of how an employer would calculate overtime hours in a semi-monthly pay period. The Paysliper salary calculator is a tool to convert your salary equivalents based on your companys payment frequency such as Monthly Weekly.

A semi-monthly payroll occurs twice each month and 24 times each year. For example if an employee earns 1500. For the cashier in our example at the hourly wage.

Ad Looking for semi monthly payroll calculator. Ad Process Payroll Faster Easier With ADP Payroll. Discover ADP Payroll Benefits Insurance Time Talent HR More.

If you work a 2000 hour work year then divide your annual earnings by 2000 to figure out your hourly wage. Multiply the number of hours the employee works in a regular week by 52 the number of weeks in a year to find the number of hours an employee works in a year. Paid a flat rate.

This method requires that you determine her regular hourly pay rate. How do I calculate hourly rate. All other pay frequency inputs are assumed to be holidays and vacation.

If you get paid bi-weekly once every two weeks your gross. Due to the nature of hourly wages the amount paid is variable. The salary calculator converts your salary to equivalent pay frequencies including hourly daily weekly bi.

Discover ADP Payroll Benefits Insurance Time Talent HR More. Paid a flat rate. Is a tool to convert your salary equivalents based on your.

Pay Your Team And Access HR And Benefits With The 1 Online Payroll Provider. To prorate the salary divide the employees annual salary by the number of paid workdays for the year. Divide her salary for the pay period by the number of hours salary is based on.

Find The Best Payroll Software To More Effectively Manage Process Employee Payments. Get Started With ADP Payroll. Get Started With ADP Payroll.

How to Calculate a Semi-Monthly Paid Employees Daily Rate How to Calculate Overtime for a Semi-monthly Payroll 1. Ad Process Payroll Faster Easier With ADP Payroll. Free Unbiased Reviews Top Picks.

Ad Join Thousands Of Other Business Owners Whove Made Their Payroll Management Easier. SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes.

9 Payroll Schedule Templates Word Docs Free Premium Templates

Hourly To Salary Calculator Convert Your Wages Indeed Com

How To Set Up Pay Periods To Work With Pay Dates Ontheclock

How To Calculate Gross Weekly Yearly And Monthly Salary Earnings Or Pay From Hourly Pay Rate Youtube

4 Ways To Calculate Annual Salary Wikihow

The Pros And Cons Biweekly Vs Semimonthly Payroll

The Art Of Calculating Overtime On A Semi Monthly Pay Schedule

Elaws Flsa Overtime Calculator Advisor

![]()

Download Free Bi Weekly Timesheet Template Replicon

The Art Of Calculating Overtime On A Semi Monthly Pay Schedule

Semi Monthly Pay Period Timesheet Mobile

What Is A Pay Period Free 2022 Pay Period Calendars

The Art Of Calculating Overtime On A Semi Monthly Pay Schedule

Hourly Wage To Biweekly Paycheck Converter Hourly Salary Conversion Calculator

The Art Of Calculating Overtime On A Semi Monthly Pay Schedule

Salaries Ppt Video Online Download

Difference Between Bi Weekly And Semi Monthly Difference Between